2022 started out with us dealing with the continuing surge and saga of COVID. The good news is that patient traffic, across nearly all specialties, has been resistant to recent COVID surges, remaining steady since the initial outbreak in early 2020.i When we examine prescribing trends, however, the story isn’t as simple.

The Highs and Lows of Total New Scripts (NRx)

As our lives turned upside down when COVID hit, so did HCPs’ prescribing habits:

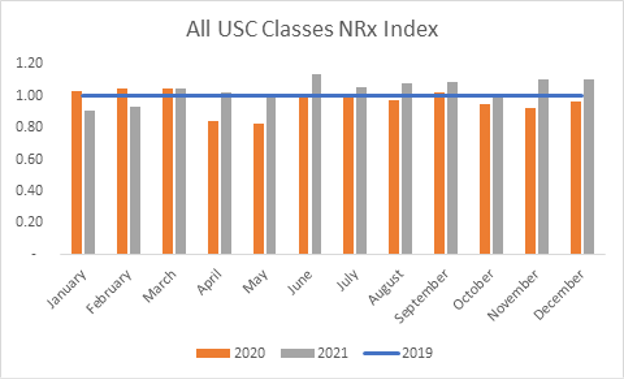

- For 2020 overall, retail NRx decreased -3% from 2019, with the largest declines happening in April (-15%) and May (-17%).

- By June 2020, NRx rebounded to +1% over the prior year.

- Soon after this point, however, total NRx fell once again, averaging -3% below 2019 levels for the remainder of the year.

In 2021, things looked up (literally). Total NRx rebounded, growing +7% over 2020 (except for January and February), resulting in overall annual growth of +3.9% over 2019.ii As you’ll see in the chart below, June had the highest year-over-year change in terms of total NRx.

It is important to note the impact COVID vaccines had on this growth in 2021. If the 113 million vaccine doses are removed from the analysis, the +7% growth shown over 2020 lessens to +2.3% and results in a -0.8% decline from 2019 baselines. So in summary: Prescription volume is up slightly over 2020 and back in line with pre-COVID rates from 2019.

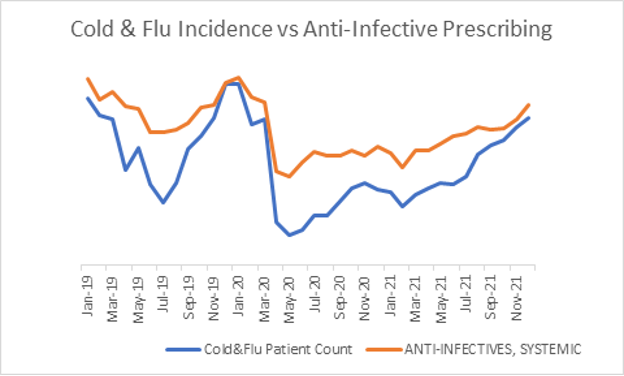

Over half of this decline in prescription volume can be attributed to two USC drug classes for cold and flu treatments: 15000-anti-infectives, SYSTEMIC and 02000-analgesics. It is no surprise that as mitigation measures were implemented to protect us from the spread of COVID, it also helped protect us from the common cold and influenza. Ironically, in some ways, COVID drove us to be healthier.iii

The Big Picture

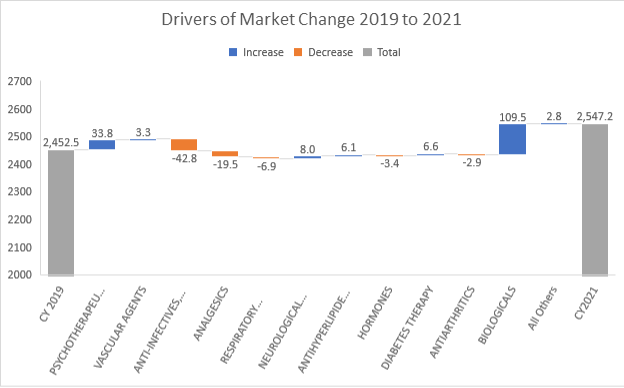

COVID’s impact varied by drug class. At the USC2 level,iv more classes experienced growth than decline. Besides the biologics class driven by COVID vaccines, psychotherapeutics was a key driver of growth, contributing 16% to total positive growth based on a +10.45 growth in volume. This is a class that has been consistently growing over the years, most recently posting +5% increase year-over-year. While some of this growth may be attributable to COVID, other classes were driven by normal market factors such as product launch (as was the case with the diabetes class, which grew +6.6% and contributed to 3% of total growth).

In total, 36 out of 70 USC2 classes had positive change in prescribing volume: O31000-vascular agents (+1.4% growth | 2% contribution to positive change), 20000-neurological/neuromuscular disorders (+7.6% | 4%), 32000-antihyperlipidemic agents (+5.8% | 3%).v

Context Is Everything

While it is true that COVID has had a negative impact on many prescribing decisions to treat acute illness such as cold and flu, the pandemic has had little effect on the prescribing of therapies to treat chronic conditions, which did not go away during COVID.

As with all our analysis, our goal is to not only deliver the data, but the context surrounding it, which is crucial for insights you can trust to guide your decisions. If you’d like to dig into the details, I’d love to speak with you. Email me at eric.talbot@patientpoint.com.